As Advisory Board and Bloomberg report, medical debt isn’t just an issue in 2022: it’s one of the most common and overwhelming issues faced by American families, even if they are insured. Here are a few statistics to know.

61% of Americans insured through their employer have medical debt.

Medical debt is often viewed erroneously as a problem only for people who skip or cannot afford to maintain health insurance. As a recent survey illuminated, insurance does not prevent patients from taking on overwhelming medical debt.

Most insured respondents attributed their medical debt in part to the complexity of the insurance coverage system. Co-pays, high deductibles, and out-of-network or “surprise” medical bills exacerbate the burden on insured Americans.

56% of American adults have medical debt.

Insured or not, most adults in the U.S. have medical debt. Many adults reported changing their plans or habits as a result of their medical debt—most commonly by:

- Not paying other bills

- Skipping vacations, dining, or entertainment

- Skip saving for retirement or emergencies

- Skip saving for a child’s college education

53% of Americans have more medical debt now than before COVID.

The COVID-19 pandemic caused the problem of medical debt to become even more widespread for U.S. families. As a result, Americans were more likely than ever to take actions like:

- Tapping into their emergency savings

- Borrowing money

- Paying bills late

- Putting large bills on a credit card

80% of Americans with medical debt postponed health care due to cost during COVID.

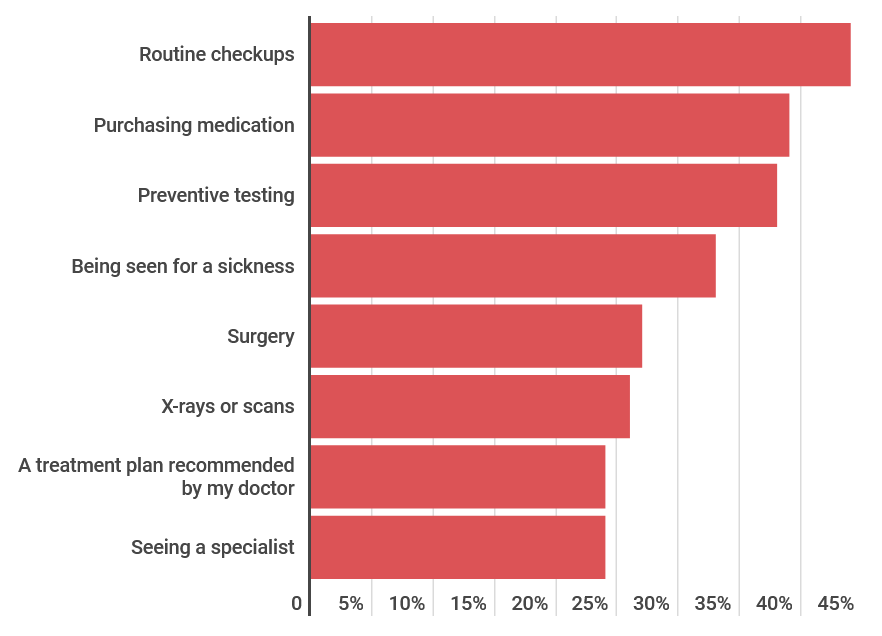

One of the most dangerous impacts of medical debt is its capacity to cause patients to delay or cancel potentially life-saving medical care due to fears about inability to pay. During the COVID-19 pandemic, the vast majority of Americans with medical debt opted to skip or postpone medical care.

Here’s what patients were most likely to postpone via Advisory Board:

63% of patients are more worried about paying off medical debt than recovering.

Medical debt can take such a mental, emotional, and physical toll that American patients are more likely to worry about paying off a medical bill than they are about their health and recovery.

Medical bills are the largest source of debt in the U.S.

In total, patients in the U.S. owed around $140 billion in medical debt alone as of 2020.

Top costs include emergency care, hospitalizations, and COVID-19 treatment.

Many insurance plans only partially cover emergency room visits and hospitalizations. Many patients are currently reporting a new source of medical debt this year: treatment for COVID-19.

1 in 6 Americans has a medical bill they aren’t paying off.

Part of the stress of out-of-pocket medical costs often stems from the fear that patients won’t have the resources to pay off their largest bills. For 1 in 6 people, paying off an outstanding medical bill is not currently an option.

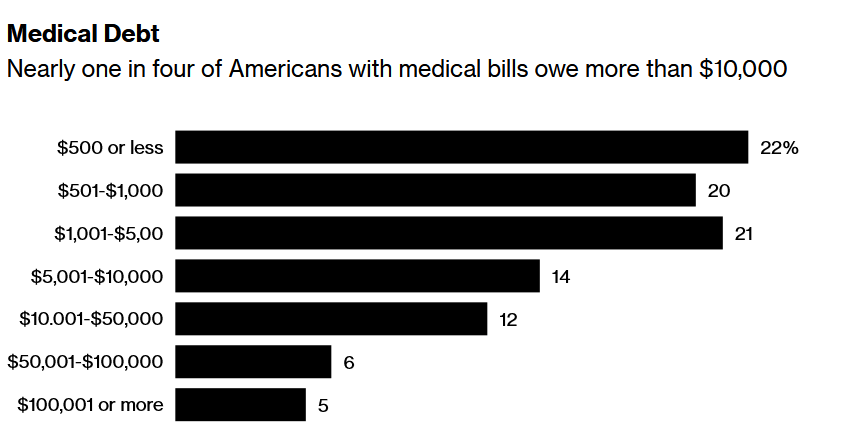

1 in 4 Americans owes more than $10,000.

While 22% of patients owe $500 or less, 25% owe $10,000 or more.

$10,000 is already an insurmountable sum for many families to cover—in fact, 40% of American families cannot cover an unexpected $1,000 expense. However, 11% of patients have an even greater weight on their minds and wallets: outstanding medical debt of over $50,000. Half of those patients have medical debt over $100,001.

Take a look via Bloomberg:

30% of Americans don’t believe they will pay off their medical debt within their lifetime.

What that statistic makes plain is that medical debt can eliminate a critical source of strength and motivation for patient families: hope.

Medical Fundraising to Restore Hope and Find Relief

At Help Hope Live, we believe that no patient or family should have to experience the overwhelming stress and hopelessness than can come along with medical debt. We provide secure, trusted, and experienced medical fundraising for patients who need help to get through the financial burden of a medical crisis.

Complete a short campaign request to apply for fundraising help for yourself or on behalf of a loved one.

Written by Emily Progin