Last updated February 13, 2024

“Do I get this medication that my child needs or pay the electric bill?”

We’ve been reporting on the unique challenges faced by Black patients in our Latest since 2020. For today’s installment, we explored a Bloomberg report that indicates how medical debt and collections can disproportionately impact Black Americans.

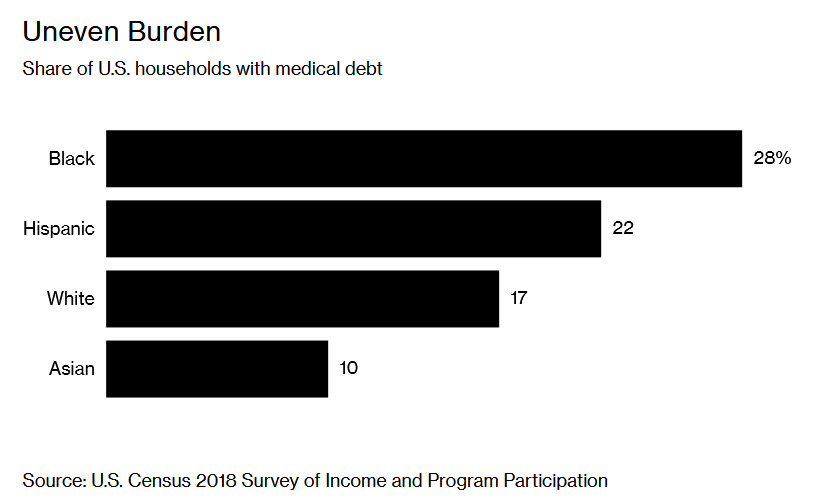

28% of Black households have medical debt.

Of the $140 million in medical debt reported by U.S. credit files, there is a clear disparity between black and white families. Just 17% of white households have medical debt compared to 28% of black households.

Black and Hispanic households are more likely to be uninsured, have a lower income, and have less savings to cover unexpected costs, including medical bills. However, additional findings from Bloomberg directly challenge the idea that these factors are causing the medical debt gap to fall along racial lines.

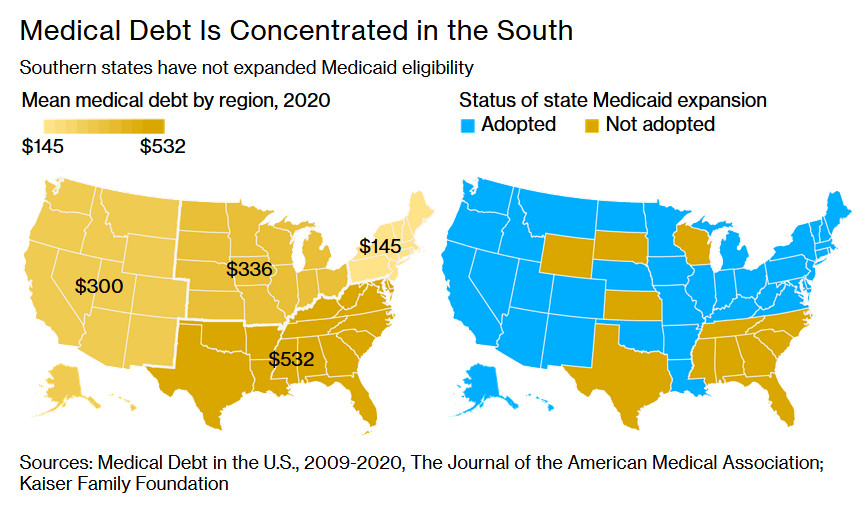

Geographic patterns show this problem is not caused by other disparities.

States like Massachusetts, Minnesota, and Washington have lower medical debt levels, and black and white households are less far apart in their medical debt. Wide disparities along racial lines are much more common in the south, particularly among states that have not yet opted to expand Medicaid eligibility.

In St. Louis, for instance, patients living in communities that are predominantly non-white are four times more likely to have medical debt in collections than patients living in predominantly white communities.

These disparities across geographic lines show that background patterns in insurance coverage, income level, and savings are not enough to account for the stark medical debt gap between black and white patients.

Black patients are more likely to face wage garnishment, high interest, lawsuits, or liens.

Medical bill collectors are more likely to target black patients than white patients with extreme debt collection measures such as garnishing wages, charging high interest rates, suing the patient, or putting a lien on a patient’s home.

A study of collection practices in New York found that hospitals continued to file liens against patients who owed medical debt even as they received ongoing funds from the state intended to help cover care for patients who could not afford it on their own.

“These are already people struggling to pay.”

Black patients are less likely to be told about financial assistance.

Even though nonprofit hospitals are required to share their charity care policies with patients, less than 50% of surveyed black patients were aware of the possibility of receiving free or low-cost care. 79% of white patients said they were aware of this possibility.

Undocumented immigrants may face an additional hurdle to financial aid: some financial aid forms require personal information that may be daunting for an undocumented individual to submit for fear of impacting their immigration status.

Racial disparities extend to patient care.

Discussing the gaps in medical debt between black and white families, black patients were quick to report their experiences with racial bias in the medical care system.

“I’ve witnessed how White people are spoken to and how things are explained to them as opposed to how I’ve been spoken to and how things have been explained to me.”

One patient reported that when she pursued medical care for a pregnancy, health care providers addressed questions to her white husband instead of to her. Her white friends also reported different care and communication experiences than she did when they visited the same medical care providers.

These experiences lead to a troubling and persistent fear for many black patients and families: wondering whether their skin color is impacting their quality of care.

Seeking solutions means proactively reducing financial harm.

“Health-care companies can’t fix the root causes of the country’s systemic inequality, but doctors and hospitals can ensure their services don’t inflict financial harm on patients.”

There are several ways for health care providers to minimize the financial harm that their patients face (and the disproportionate burden that patients of color may face).

The American Hospital Association recommends that health care organizations refrain from engaging in the following practices unless they can clearly establish that a patient is able to pay but unwilling to do so:

- Reporting patient debts to credit bureaus

- Suing patients

- Garnishing wages

Health care companies and nonprofits can also make an impact by choosing to:

- Critically re-evaluate how they screen patients for financial assistance

- Reviewing how and when they communicate with patients about their financial assistance options

- Contacting eligible patients who owe a medical bill proactively to tell them about their financial assistance options

- Changing the next steps they take or their timeline on taking action when a medical bill goes unpaid

For now, all of these guidelines and choices remain optional: it is up to health care organizations to choose whether to review and alter their policies.

Do you need help covering medical costs?

Keep in mind that our nonprofit is a trusted and secure lifeline for patient families facing overwhelming medical costs. Click here to learn how Help Hope Live is different from other fundraising options like GoFundMe.

Written by Emily Progin