Glenmede is a long-time supporter of hope, including through sponsorship of the local events that consistently fuel Help Hope Live’s mission. For this post, we asked the Glenmede team for their top insights on planned giving.

Philanthropy is an integral part of the American DNA. Today, individual and family donations exceed corporate and foundation grants by a factor of four. Despite their generosity, a 2018 U.S. Trust Study of High Net-Worth Philanthropy reveals that less than half of U.S. donors have a formal giving plan.

A Purposeful Approach Yields More Tangible Results

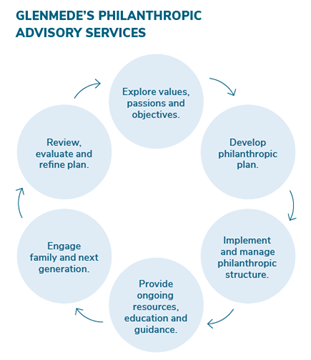

While “checkbook philanthropy” is an intuitive and altogether acceptable means of supporting a cause or charity, a planned approach guides you to think more boldly and broadly about what matters most to you, the impact you want to have and the degree of direct family involvement you want to achieve. It means having a strategy to reach your full potential—and derive the greatest satisfaction from giving.

Before creating a plan, it’s essential to have a clear understanding of your passions, values and philanthropic vision. Whether it’s supporting an educational institution, global cause or community initiative, you should carefully assess the benefits, practical outcomes and even the scope and scale of giving—local, national or global. You should also consider the legacy for which you and your family want to be known.

The Power of a Plan

Like a business plan, a philanthropic plan articulates future objectives and the means for achieving them with sufficient nuts-and-bolts detail. A practical working document should incorporate structures, guidelines and governance roles and responsibilities, as well as procedures for ongoing monitoring, assessment, and refinement.

Any decisions should reflect the long-term strategy. For example, donors need to consider whether giving should be concentrated with a single organization, cause, or geography or spread out among many. While donors may stipulate the way their gifts are to be used, it isn’t necessary for each dollar to be earmarked for a specific purpose. Unrestricted gifts can play a vital role, helping organizations to cover essential operating expenses.

Nor do plans need to be set in stone. Indeed, a sound plan may evolve over time. For example, a donor might decide to support certain charities for three to five years, allowing the recipient organizations to budget accordingly, then opt to support different organizations in the future.

Financial and Tax Considerations

Philanthropy is first and foremost an expression of your values, ideals, and the difference you want to make. But it also should incorporate broader financial considerations. How much can you afford to give in the long term, or in any one year? How should tax considerations figure into your giving? These are critical questions that should be carefully addressed during a well-orchestrated goals-based wealth review.

Engage the Family

Involving family members yields a range of important benefits. It provides a means to pass on core values, create a larger pool of assets to amplify their impact, and preserve a founding mission across multiple generations. Family foundations, donor-advised funds, and volunteering as a group are especially suited to optimizing family-based philanthropy—and bringing family members closer together.

For families with existing plans, it is important to remain flexible and open to the ideas and priorities of younger generations. For example, a broad theme, such as conservation, can allow different generations to support their own initiatives, such as preserving open spaces, supporting wildlife, or fighting climate change.

From Vision to Reality

For those who have achieved financial success, one of the great dividends is the pleasure of giving back. Giving strategically with careful planning enables thoughtful allocation of assets for greater impact.

The process of creating a plan can help families and individuals think through their goals with heightened clarity. With professional support and guidance, the planning experience becomes a journey of self-reflection and discovery. This ultimately can lead to a giving strategy aligned with a goals-based wealth plan that turns a philanthropic vision into reality.

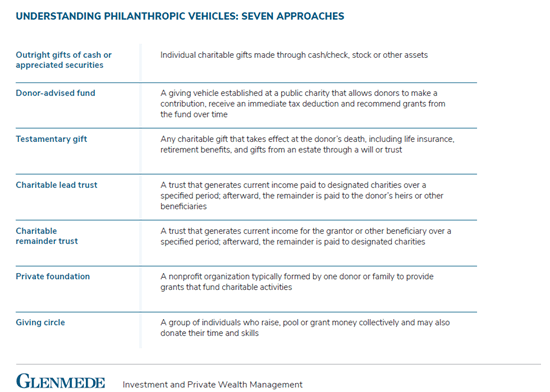

There are many tax-efficient philanthropic investment vehicles for donors to consider. Once you formulate your giving plan, you can evaluate appropriate tax and estate planning strategies, again in the context of your overall wealth plan.

This material provides information of possible interest to Glenmede’s clients and friends, and does not provide investment, tax, legal or other advice. It contains Glenmede’s opinions, which may change after the date of publication. Information gathered from third-party sources is assumed reliable but is not guaranteed. No outcome, including performance or tax consequences, is guaranteed, due to various risks and uncertainties. Clients are encouraged to discuss anything they see here of interest with their Glenmede Relationship Manager or tax advisor.

Written by Help Hope Live