One of the biggest benefits of working with Help Hope Live for medical fundraising is that our organization is a 501(c)(3) nonprofit.

Our nonprofit status provides unique benefits to the clients who fundraise with us and their communities of support.

In this blog post, you’ll learn what a 501(c)(3) is, whether a 501(c)(3) is different than a nonprofit or a charity, and why our nonprofit status matters to donors and clients.

This post was last updated in January 2025.

What is a 501(c)(3)?

501(c)(3) is part of the IRS tax code that indicates whether organizations are tax exempt and can receive tax-deductible donations.

According to the IRS, 501(c)(3)s can be “religious, educational, charitable, scientific, literary, testing for public safety, national or international amateur sports competition, or prevention of cruelty to children or animal organizations.”

As Charity Navigator explains, what sets 501(c)(3) organizations apart from private organizations is that they are public charities that “serve the common good.”

Organizations that rely on private membership donations or serve a primarily social or recreational purpose typically fall under a different IRS category.

Is a 501(c)(3) the same thing as a nonprofit?

No: all 501(c)(3) organizations are nonprofits, but not all nonprofits are 501(c)(3)s.

As explained above, for a nonprofit to be a 501(c)(3), it must be recognized by the IRS with this specific status. Help Hope Live is classified by the IRS as a 501(c)(3) nonprofit.

Is a nonprofit the same thing as a charity?

No: all charities are nonprofits, but not all nonprofits are charities.

For a nonprofit to be a charity, it must serve the public good rather than a private or members-only group. Help Hope Live is a considered a charity as well as a nonprofit.

Why does 501(c)(3) status matter?

If an organization is a 501(c)(3) like Help Hope Live, donations to that organization are tax deductible to the full extent of the law on your annual tax return.

The only way to make sure that your donation to a nonprofit will be tax deductible is to donate to 501(c)(3) nonprofits like Help Hope Live.

Is Help Hope Live a 501(c)(3)?

Yes: Help Hope Live is classified as a 501(c)(3) nonprofit.

Is Help Hope Live a charity?

Yes: Help Hope Live is a charity.

What is Help Hope Live’s charity rating?

Help Hope Live earns a 99/100 rating from the independent platform Charity Navigator.

This rating takes into account multiple factors, including our impact, financial efficiency, how we use donations, our organizational governance, and the culture and community around our mission.

We also receive the highest-possible four-star overall rating from the platform.

That puts our nonprofit in the top 1% of charities in the country.

Click here to see our rating and how we earn it.

Why does it matter that Help Hope Live is a 501(c)(3) nonprofit?

Help Hope Live’s status as a 501(c)(3) nonprofit is important for several reasons – we’ll give you a quick explanation, but scroll down for a more complete breakdown.

In short, Help Hope Live’s 501(c)(3) nonprofit status matters because:

- Donations to Help Hope Live are tax deductible

- Donations to Help Hope Live in honor of a client are tax deductible

- Our administrative fee benefits our mission instead of padding profits

- Help Hope Live will responsibly manage every donation to fulfill our mission

- Funds raised are administered by us and typically won’t jeopardize asset-based benefits

- Client campaigns are eligible for special opportunities only available to nonprofits

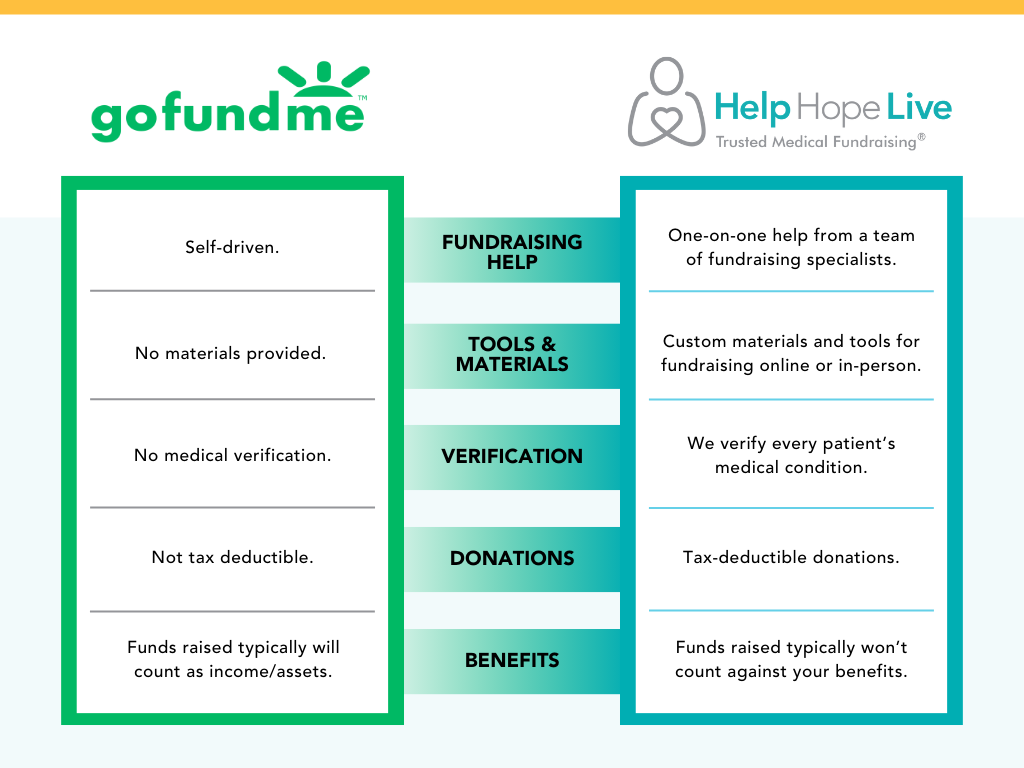

Here’s how we compare to GoFundMe:

Details on why our nonprofit status matters:

Because Help Hope Live is a 501(c)(3), donations to Help Hope Live are tax deductible.

That applies to both donations to our organization as a whole and donations made in honor of a client.

Click here to learn more about how that makes us different from other fundraising options like GoFundMe or payment apps.

Our administrative fee benefits our mission instead of padding profits.

Our admin fee is a low 3% for check donations. We do not use this nominal fee to make a personal profit: instead, all the funds we raise through our admin fee goes towards maintaining our staff, strengthening our mission, and providing personalized fundraising help and tools to every client who works with us at no cost to them.

Supporters can give with confidence knowing we will responsibly manage every donation to fulfill our mission.

Our clients can encourage their community to make donations in their honor knowing that funds raised will always be managed responsibly and go where they are needed most.

To add to this donor confidence even further, we verify each client’s medical condition, and funds raised can only be used to cover verified medical expenses and related costs.

Funds raised in honor of our clients are administered by us, so those funds typically won’t count as personal income or assets for our clients.

That means we provide the maximum protection for our clients’ eligibility for asset-based benefits such as Medicaid. We encourage every client to check with their local benefits office for full confidence.

In contrast, for-profit platforms like GoFundMe may jeopardize client benefits – read Patrice Jetter’s story for an example.

Client campaigns are eligible for opportunities that only apply to 501(c)(3) nonprofits.

These opportunities can include matching donations from employers, grants, foundation gifts, and gift-in-kind donations from businesses. We work one-on-one with clients and their communities to make the most of these opportunities as part of our personalized fundraising assistance.

Click here to learn more about why working with Help Hope Live is different than fundraising with other platforms.

Make Us Your Charity of Choice

Whether you start a medical fundraising campaign with our nonprofit or make a donation to support our mission, our 501(c)(3) nonprofit status means you can join our network of hope with full confidence in the work we do and how we do it.

Still have questions? Contact us. We would love to help you better understand our program, mission, and nonprofit designation.