Wondering about the potential taxes associated with popular online fundraising options, including mobile cash apps like Venmo, Zelle, and PayPal – or Facebook Fundraisers and GoFundMe? Not sure whether you have to pay taxes on fundraiser money?

Even if you’re fundraising specifically for medical expenses, it’s not always made clear whether funds you raise will be considered taxable income – that’s why we wrote this post.

This post will help you understand the potential tax implications of fundraising through these platforms – and why you get better protection when you fundraise with our nonprofit Help Hope Live.

Updated in January 2025

Can medical fundraising impact your taxes and benefits?

The short answer is, yes: depending on which platform you choose, medical fundraising can impact your taxes and asset-based benefits.

If the funds you raise go into a personal bank account, they are typically considered taxable personal income or assets.

Even if those funds are going to be used exclusively for medical expenses and related costs, they can potentially cause you to exceed income or asset limitations associated with asset-based benefits such as Medicaid.

Our nonprofit is designed to offer the maximum protection for asset-based benefits.

When you fundraise with Help Hope Live for medical costs and related expenses, all donations are made to our nonprofit and administered by us, so funds typically won’t count against your other benefits.

Always check with local benefits offices to fully understand how medical fundraising will impact you – whether you choose to fundraise with us or another platform.

Click here for more information about our unique nonprofit advantage for trusted medical fundraising.

Click here to learn why our 501(c)(3) nonprofit status helps us to maximize that advantage for our clients.

Keep reading to learn how other fundraising options can impact taxes, income, or assets.

Do you have to pay taxes on a GoFundMe?

If you are considering starting a GoFundMe for medical fundraising, whether to help yourself or someone else, be careful.

When it comes to taxes, GoFundMe offers a complicated view of the funds that individuals raise through their platform.

Even if they are intended to be used for medical costs and related expenses, funds raised through a GoFundMe could cause the recipient to be on the hook for taxes – and even put their asset-based benefits at risk.

While some GoFundMe campaign donations may be considered “personal gifts” that don’t lead to tax implications for the recipient, there are no guarantees.

In fact, we’ve seen many examples of clients who have lost their benefits due to a GoFundMe medical fundraising campaign – here’s just one example.

Starting a GoFundMe means taking on the risk that the recipient of the funds will be liable for associated taxes.

There are several factors that potentially influence whether GoFundMe funds are taxable for the beneficiary, included the “intended use” of the funds and the total raised.

It’s up to the recipient of the funds (or their community) to correctly document the funds raised and navigate the specific tax implications that may apply to their fundraiser.

This creates a frustrating potential trap for the recipients of GoFundMe campaigns – and it’s one of the reasons why our nonprofit exists as a safer, stronger medical fundraising option.

Are Facebook Fundraisers considered personal income?

As of November 31, 2023, Facebook no longer allows you to start a “personal” or “personal cause” Facebook Fundraiser.

If you work with a nonprofit like Help Hope Live for fundraising, you can still use Facebook Fundraisers to fundraise for a nonprofit.

With nonprofit Facebook Fundraisers, the funds you raise go directly to the nonprofit of your choice (such as Help Hope Live).

Funds raised through a nonprofit Facebook Fundraiser are not personal taxable income to the individual who started the Facebook Fundraiser.

When donations from Facebook Fundraisers come to Help Hope Live in honor of a client, the client will not owe taxes on those funds.

Start with our Facebook Fundraiser guide if you’d like to start a Facebook Fundraiser to benefit Help Hope Live in honor of a client. Keep in mind that Facebook/Meta introduced a new fee structure in 2024, detailed in the blog post.

Do you owe taxes if you fundraise via Venmo, PayPal, and cash apps?

More people than ever are turning to peer-to-peer payment apps like Venmo, PayPal, and Zelle to raise funds for personal causes.

While using a payment app to collect contributions may feel like a quick and easy way to get community support, keep this in mind:

Receiving funds through a payment app that may be considered “personal income” can leave you on the hook for the associated taxes.

Are funds raised via Venmo, PayPal, or cash apps taxable income?

Funds you raise through apps like Venmo and PayPal go directly into an individual’s bank account or become available in their payment app accounts for personal use.

As of November 26, 2024, payment apps are required to report transactions when the amount of total payments for those transactions is more than $5,000 in 2024; more than $2,500 in 2025; and more than $600 in calendar year 2026 and after.

That means if you raised more than $5,000 in 2024 through payment apps, those apps will report that income to the IRS, and you will be required to file tax documentation accordingly.

By 2026, any amount raised through payment apps over $600 will be reportable income for the IRS.

If they are reported as income by these payment apps, that also means these funds may count against your asset-based benefits – and keep in mind that if you use these apps for fundraising, you may not know you’ve exceeded the threshold until you owe taxes on the funds.

For medical expenses and related costs, our nonprofit exists as a safer, stronger fundraising option.

Are “personal contributions” in payment apps taxable income?

Some personal contributions are not taxable for the recipient—examples include reimbursement from a friend, a roommate’s share of the rent, or funds that are considered a “gift” to the recipient.

It is up to the recipient of these funds to carefully track each contribution, plus its intention and use, and report the details when they file their taxes.

When you use any of these kinds of platforms to fundraise, you are responsible for tracking the funds raised and their intended use and ensuring there is a way to verify the giver’s intent when they sent funds to you.

This may be a large burden, especially if you or someone you care about is already dealing with a medical emergency or other urgent need.

Explore all your options before you start fundraising, and keep in mind that options like Help Hope Live provide the greatest possible protection for individuals and communities fundraising for medical expenses and related costs.

Why Fundraising with Help Hope Live Is Different

At Help Hope Live, we believe that fundraising should be about community support, generosity, and meeting critical needs—not navigating the tax system.

That’s why we administer all the funds raised in honor of our clients: to help prevent those funds from becoming a tax burden to our clients or jeopardizing their asset-based benefits.

Out of all the fundraising options available to you, from GoFundMe campaigns to payment apps, Help Hope Live is the only option that offers maximum relief and protection regarding tax obligations for individuals who need community support and financial assistance for medical costs.

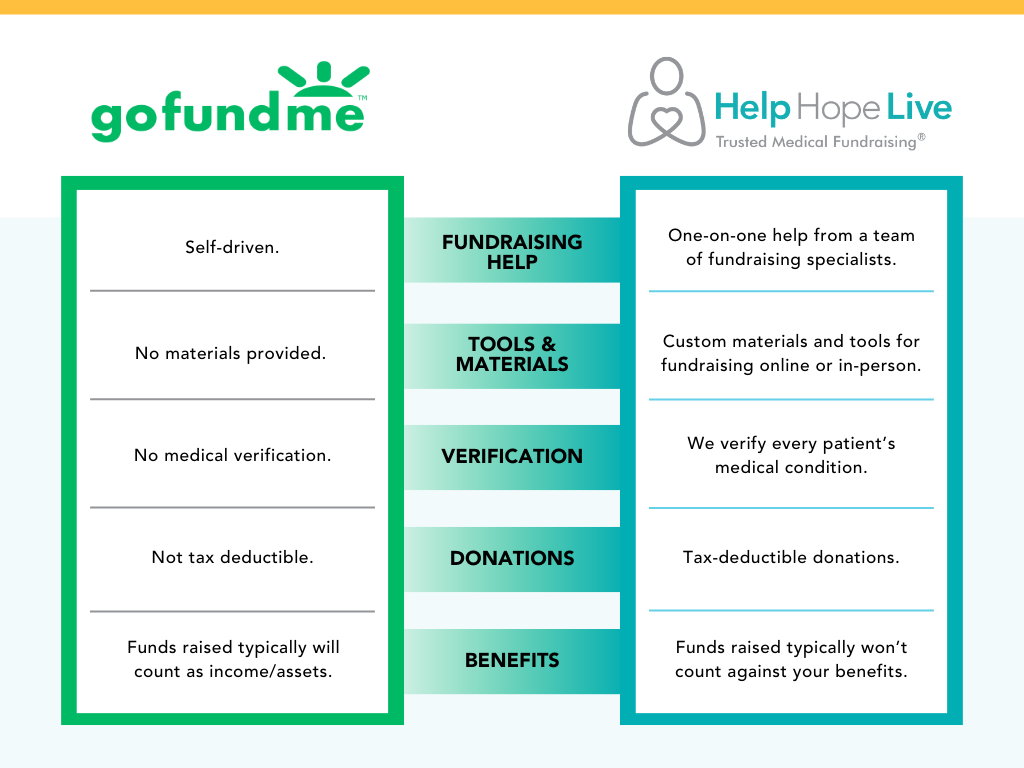

Here’s how we compare to fundraising options like GoFundMe:

Click here for a breakdown of how our 501(c)(3) nonprofit status gives our clients a unique advantage for trusted medical fundraising.

Always keep in mind that while we know our nonprofit inside and out, we are not tax professionals.

If you have tax-related questions about the content in this post and need further guidance, ask for help from a tax expert.

What to Read Next

If you’re considering your options for medical fundraising, click here to learn about fundraising with our nonprofit Help Hope Live.

For a breakdown of why our nonprofit status matters to our clients and donors, click here.

For a deeper dive into our mission or answers to specific questions, click here to access our FAQs.

Not finding the info you need? We’re not tax pros, but we are medical fundraising experts – contact us if we can help.